Don’t Let Credit Be Spooky

To many people, the word “credit” can be haunting. As a financial institution, Legacy wants to be a valuable resource and help make our members and non-members aware of the facts and fiction of credit. We will give you actionable ways to help build your credit score, and get you a higher credit in no time.

Before we get started, let’s define what credit is and why it is so important. According to Investopedia, credit is defined as “a contract agreement in which a borrower receives a sum of money or something of value and repays the lender at a later date, generally with interest.” Today you can find credit for almost anything. There are the most popular form of credit: car/auto, home loans, and credit cards. There are also travel loans and even more popular are store credit cards where you can only use that card at the brick and mortar store and eventually pay off the product that you are wanting. Good credit is necessary for major purchases, such as a house or a car. Potential employers and landlords also may request credit information during the selection process. Creditors grant and lend based on their confidence that you can be trusted to pay back the credit that you borrowed.

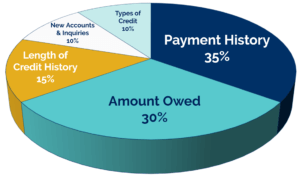

What goes into a credit score? And what is considered a “good” credit score? It’s important to know what all goes in to your credit report so that way you are an informed consumer. According to Forbes, the largest portion of your credit report is made up of your Payment History (35%). Are you making payments on-time? If not, this is a great way to attempt improving your credit score as it makes up the highest percentage. The second highest percentage that goes into a credit report is Amount Owed (30%). If you maintain a low balance-to-limit ratio, otherwise known as your credit utilization ratio, this will also help you produce a better credit score. It is also important to have an idea of the total amount of debt that is on your credit report (credit cards, mortgages, auto loans, student loans, etc.). Next would be the Length of Credit History (15%). The longer the account is open and the more it is well managed, the greater it could improve your credit score. Then we have New Credit which makes up 10% of your credit report. This is determined by how many hard inquiries appear on your credit report for 24 months. The final 10% comes from what is called Credit Mix. Your credit mix comes from what type of accounts you have that appear on your credit report.

Credit scores range from 300 to 850. As a consumer it is import to know where your credit falls on the spectrum and what are some characteristics of a consumer in that type of situation. Anything lower than 580 would be considered a “Poor” credit score. Typically these users have had multiple late payments or could even default on their credit. Scores between 580 and 669 are deemed “Fair.” These consumers only have a few things on their reports that are affecting their scores. Whether it is that you don’t have an established account or you may have missed one payment. If your credit score is between 670 and 739 this is a “Good” score. Consumers in this range are considered dependable by creditors and are more than likely to receive better rates on their loans or other forms of credits. The range between 740 and 799 are deemed “Very Good.” They usually make their payments on time each month and have a longer history of credit. Lastly, we have scores between 800 and 850. It’s important to know that having an 850, or perfect score, is very rare. But anything over 800 is seen as “Exceptional.”

Now that you know why it is crucial to have good credit, we should address common myths about credit.

- Myth #1: Using Credit Cards means living beyond your means.

- Truth #1: Having a Credit Card does not mean that you have to live beyond your means. In fact most people who do have credit cards only use them to either build credit or to take advantages of the rewards that the card may offer. A good rule of thumb would be to treat your credit card how you would treat your debit card. Use it when you have money available to pay for it.

- Myth #2: Checking my credit score will cause my score to drop.

- Truth #2: Checking your credit report is counted as what is called a “soft inquiry,” which doesn’t affect your credit in most cases. Some credit cards also offer your FICO score monthly with your monthly statements. However, if your credit is being pulled by multiple sources in a small period of time this could affect your credit score.

- Myth #3: All credit cards come with high interest rates.

- Truth #3: There are cards out there that do come with high interest rates. However, there are multiple options that come with reasonable interest rates. It’s important to remember that you as the consumer are in charge of your decisions. If you are uncomfortable with higher interest rates, it would be wise to opt for a card with a low fixed rate.

- Myth #4: Having multiple credit cards hurts your credit score.

- Truth #4: It is important not to open multiple credit card accounts within a short amount of time. Utilizing multiple cards can actually help your credit score. If you have a large amount of debt or you are having a difficult time making your monthly payments, having multiple cards may not be right for you. But similar to Myth #1, many people use multiple cards to take advantage of the benefits and rewards that the card offers while building or maintaining good credit.

- Myth #5: Canceling, or closing, unused cards will improve your credit score.

- Truth #5: Many people support closing old or inactive accounts as a way to improve your overall credit score. When in reality, closing established accounts can shorten your credit history, which makes up 15% of your overall score. It can also decrease your available credit and could increase your credit utilization ratio. These are both great reasons to keep those credit accounts open.

Here are a few tips on how to better manage your credit:

- Pay on time – As we pointed out earlier, 35% of your credit report comes from Payment History. This is a great place to start, even if it is just your monthly minimum payment. Making your payments on time, whether it is your credit card payment, your mortgage, or car note this is an easy way to begin to raise your credit score or maintain your credit score.

- Maintain low or no balances – With 30% of your credit report being amount owed, it is important to keep a low balance on things like credit cards and personal loans. Obviously, for larger loans like mortgages and car loans it will take a longer time to pay that down, but that’s where it is important to make the payments on time.

- Utilize a budget – Having something where you can view all your income, expenses, and debts in one location allows you to manage all aspects of your finance more effectively. It can be easy to overlook payments that are due or overspend if you aren’t able to look at the big picture of your finances. Having a budget will allow you to see directly where your money goes, if you can save money in a specific category, and can also keep track of your total credit and credit utilization.

Legacy offers a variety of products and services to help you achieve your financial goals. We offer Auto & Recreational Loans for both new and used vehicles. We also offer multiple types of mortgages for families buying their first house, or for those that are settling down into their forever home. When it comes to Credit Cards, Legacy has two types of cards: VISA Platinum Credit Card and a VISA Platinum Preferred Credit Card. Our VISA Platinum Card has a 12.90% APR and the Platinum Preferred card offers an 8.90% APR. Both have fixed rates lower than the average Annual Percentage Rate across all credit cards (21.40% APR according to Lending Tree). Each card has their own benefits and rewards, and we invite you to visit our credit card page to read more about our options.